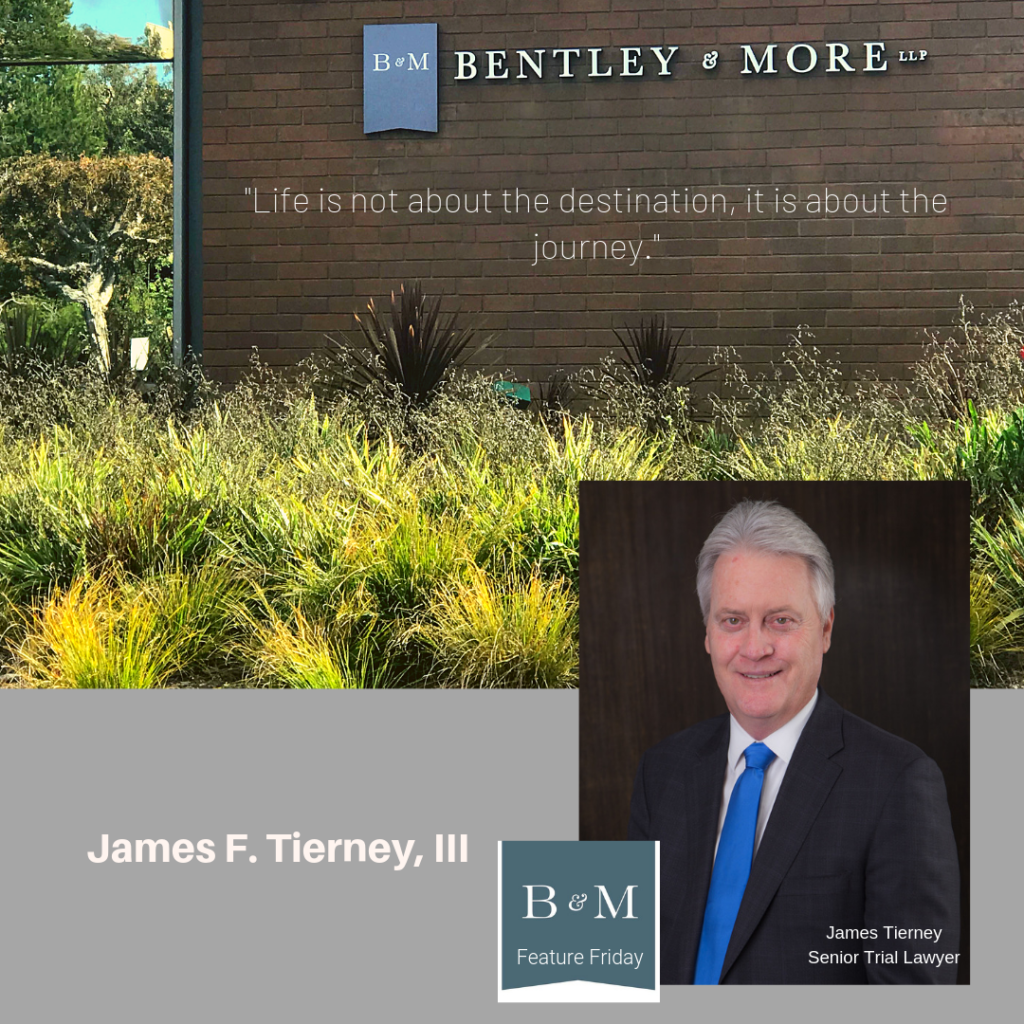

This week we bring to you James F. Tierney from our Redlands Office. James joined our team at the back end of 2018 and we are so glad he did. We were ready for expansion and we couldn’t think of anyone better than to represent us up in the Inland Empire.

James F. Tierney, III, has spent decades residing in, and litigating throughout, the Inland Empire, providing him with a nuanced, experienced view of the particular circumstances presented by litigation in this part of Southern California. Although he has litigated on both sides of the Bar, Mr. Tierney has now spent the last 18 years exclusively devoted to fighting on behalf of injured individuals throughout California. Mr. Tierney serves as a Senior Trial Attorney with Bentley & More LLP and is the firm’s primary attorney in its Inland Empire office in Redlands, CA.

Mr. Tierney began his practice as an associate with a major Inland Empire insurance defense firm. In 1990, he became a partner in the firm of Stanfield & Warner, primarily practicing in the fields of insurance defense, as well as public entity defense and police civil liability defense for the County of San Bernardino. In 1996, Mr. Tierney’s firm merged with a leading Orange County defense firm, where he became the managing partner of their Inland Empire office. In 2000, he decided to devote his practice to representing plaintiffs, including consumers and injured individuals, after spending over 16 years representing defendants in personal injury cases.

Mr. Tierney’s current practice focuses on the representation of a wide variety of plaintiffs in personal injury and wrongful death cases. His extensive trial experience earned him membership in The American Board of Trial Advocates (ABOTA), an honor bestowed on very few trial attorneys nationwide He was even the ABOTA San Bernardino/Riverside Chapter’s President in 2009. Mr. Tierney is also an active member of the Consumer Attorneys of California, the American Association for Justice, the San Bernardino County Bar Association, the California Bar Association, and the Joseph P. Campbell Inns of Court. He has volunteered as a Judge Pro Tem and has also worked as an Appellate Court Mediator at the Fourth District Court of Appeal in Riverside.

Mr. Tierney is AV® Preeminent™ rated by Martindale-Hubbell. This is the preeminent rating, achievable only after admission to the bar for at least ten years, indicating the highest level of legal ability and ethics.

Mr. Tierney has been selected for inclusion in The Best Lawyers in America and has also been selected as a Southern California Super Lawyer for Personal Injury from 2012-2018.

Finally, Mr. Tierney has been a resident of the Inland Empire for well over 40 years, having grown up in the High Desert and then living and raising his family in the San Bernardino area for the past 25 years. He is active in the community and was recently named to the Board of Directors for Junior University, an organization devoted to developing and encouraging young musical performers to learn and practice their craft in presenting quality and professional summer programs in San Bernardino.

Read More